How to Use Alipay as a Foreigner in China 2025 - Learn How to Link Your Credit Card and More

Contents

- Why Setting Up Alipay Before Your Trip to China is Essential

- How to Link Alipay with a Foreign Credit Card

- What You’ll Need

- Step-by-Step Guide

- Troubleshooting Common Issues

- Rules and Limitations of Using a Foreign Card on Alipay

- Fees

- Transaction Limits

- What You Can Pay For

- Alipay TourCard: Unlocking More Payment Options

- What Is Alipay Tour Card?

- How to Set Up a TourCard

- Linked Foreign Card vs. TourCard: Which to Use When

- Essential Tips for International Travelers Using Alipay in China

- Pre-Travel Preparation

- On-the-Ground Tips

- Avoiding Common Pitfalls

Show more

Planning a trip to China? You should know that cash and foreign credit cards are not always accepted in its cashless society, where over 90% of payments are made via mobile apps like Alipay. For non-Chinese travelers, Alipay is a lifeline for paying at shops, restaurants, and even public transport.

The good news?

You can easily link Alipay with a foreign credit card, such as Visa or Mastercard, to shop like a local. In this guide, we'll walk you through the process of how to link Alipay with a foreign credit card, from setup to verification, and introduce the Alipay TourCard for broader payment options. We’ll cover step-by-step instructions, fees, limits, and tips to ensure Alipay works seamlessly on your trip. Set up before you go, and you’ll avoid payment hassles in China’s bustling digital economy.

Alipay is China’s leading mobile payment app, powering billions of transactions for shopping, dining, and transportation. It’s an essential app for international travelers, as cash is rarely used, and foreign credit cards can get rejected outside major hotels or stores.

Alipay for foreigners offers a user-friendly English interface and allows you to link a foreign card to pay via QR codes, making it easy to purchase food, souvenirs, book a taxi, or pay for a subway ride.

Setting up Alipay ensures you’re ready for China’s cashless world, saving you time and stress.

Setting up Alipay with a foreign credit card is straightforward and essential for travelers navigating China’s cashless economy. By linking a supported international card, you can pay at millions of merchants using Alipay’s QR code system.

Before you begin, gather the following to link your foreign card to Alipay:

Latest Alipay App: Download from the App Store (iOS) or Google Play (Android). Ensure it’s updated for full functionality.

Supported Card: Use a Visa, Mastercard, JCB, Discover, or Diners Club card. American Express support is limited (Lower transaction limits, lower merchant acceptance vs. Visa/Mastercard)

Valid Passport: Required for verification; the name on the passport must exactly match the name on your card.

Stable Internet Connection: Needed for app navigation, verification, and card linking.

International Phone Number: Use your home country’s phone number or email for signup and verification.

Follow these steps to link Alipay with a foreign credit card and start using it in China:

1. Download the Alipay app and Sign Up:

- Install the Alipay app from the App Store or Google Play.

- Open the app and tap “Sign Up.” Enter your international phone number or email address.

- Verify your account with the SMS code sent to your phone or email.

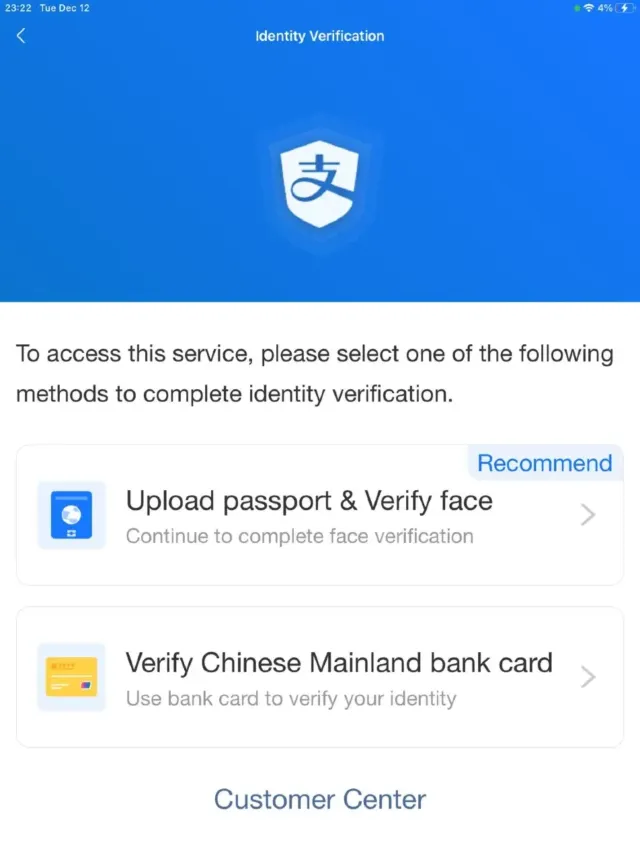

2. Complete Real-Name Verification:

Before you can link a foreign credit card to Alipay, you must complete real-name verification, a mandatory step for non-Chinese passport holders. This process ensures your identity matches the cardholder’s name, enabling secure payments in China. Completing real-name verification before your trip is critical to avoid delays or issues when setting up Alipay. Follow the prompts to:

- Access Settings: Tap “Account” in the bottom right corner, then click the gear-shaped settings icon in the top right.

- Go to Real-Name Verification: Select “Account & Security,” then tap “Real-Name Verification.”

- Enter Passport Details:

Click “Change Country/Region” in the top right, select your country (e.g., United States).

Upload a photo of your passport and fill in personal details.

Complete a live facial recognition scan (use good lighting, remove glasses/hats).

- Submit for Verification: Click “Submit.” Verification typically takes minutes but may take up to several hours.

Once approved, you can proceed to link your card. If verification fails, double-check your details for accuracy or contact Alipay’s in-app “Customer Service” (headset icon).

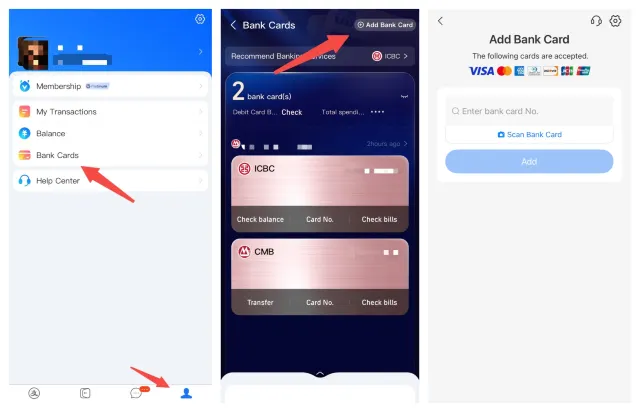

3. Access Bank Cards:

- Once your account is verified, tap the “Account” icon (located in the bottom right corner of the app).

- Select “Bank Cards” from the menu.

4. Add Your Card:

- Tap the “+” icon (usually top right) to add a new card.

- Choose “Add Bank Card.”

5. Enter Card Details:

- Input your full name as it appears on your card.

- Enter the 16-digit card number, expiry date (MM/YY), and CVV (3-digit code on the back).

6. Set Payment Password:

If you’re a new user, create a 6-digit Alipay payment password to authorize transactions.

7. Verify Card (If Prompted):

- Your bank may send a small temporary authorization charge (e.g., $1–2 USD) to your card.

- Check your bank statement or app for the exact amount.

- Enter this amount in Alipay when prompted to confirm you control the card.

Once verified, your card will appear in the “Bank Cards” list under “Account,” marked as an “International Card.” You’re now ready to pay with Alipay.

If you encounter issues while linking your card, try these solutions:

Card/Passport Name Mismatch: Ensure the name on your passport exactly matches the name on your card. Even small differences (e.g., middle initials) can cause verification to fail. Double-check and re-enter details carefully.

Bank Transaction Blocks: Some banks flag Alipay’s verification charge as suspicious. If the card addition fails, check your bank’s app or contact their support to approve the transaction. You may need to retry the process.

Verification Delays: Passport verification can take a few hours. Ensure your photos are clear and well-lit. If it fails, re-upload images or try again in better lighting.

App Errors: If the app crashes or buttons don’t work, ensure it’s updated to the latest version. Restart the app or reinstall it if needed.

Once you’ve learned how to link Alipay with a foreign credit card, understanding its rules and limitations is crucial for managing expectations in China’s increasingly cashless economy.

Using Alipay as a foreigner offers convenient QR code payments but comes with specific fees, transaction caps, and restrictions on services. Below, we outline what you can do, associated costs, and strict limits for Alipay for foreigners, ensuring you’re prepared for seamless payments during your trip to China.

Using a foreign credit card on Alipay incurs the following fees:

Alipay Service Fee: A 3% fee applies to transactions over ¥200 (~ USD 28), displayed at checkout. Transactions of ¥200 or less are fee-free. For example, a ¥1,000 purchase incurs a ¥30 fee.

Bank Fees: Your card issuer may charge a fee of 1–3% for foreign transactions or currency conversion, depending on their policy. Check with your bank to confirm additional costs.

Exchange Rates: The exchange rate is set by your card’s issuing bank or card scheme (e.g., Visa, Mastercard). Alipay doesn’t add a markup, but rates may differ from the mid-market rate.

Alipay imposes strict limits on foreign card transactions for verified accounts (passport-verified):

Single Transaction: Up to ¥35,000 (~$4,800).

Monthly: ¥100,000 (~$13,700), covering all transactions in a calendar month.

Annual: ¥¥500,000 (~$68,500), shared across all Alipay accounts under the same passport/ID.

These limits apply to all foreign cards (Visa, Mastercard, Amex, JCB, Discover, Diners Club). Monitor usage to avoid hitting caps, especially for big purchases.

A linked foreign card enables many payments but has restrictions.

| Supported Services | Unsupported Services |

| In-store purchases at stores, restaurants, supermarkets, and tourist attractions. | Person-to-person (P2P) transfers. |

| Public transport (subways, buses, some taxis). | Sending or receiving red packets (digital gift money). |

| Online purchases and booking on platforms like Taobao, Tmall, or Didi (ride-hailing). | Utility bill payments (electricity, water, etc.). |

| Some high-speed train or flight bookings via Alipay’s mini-programs. |

Note: Some smaller vendors or rural merchants may reject foreign-linked Alipay payments due to compatibility issues. Test your card with a small purchase (e.g., ¥10 at a convenience store) upon arrival to confirm acceptance.

For unsupported services, consider the Alipay TourCard (see below) or carry small amounts of cash as a backup.

For non-Chinese travelers, linking a foreign card to Alipay covers many payments; however, some services, such as peer-to-peer transfers, may require a Chinese bank account. The Alipay TourCard, a prepaid virtual card, solves these limitations, offering broader functionality for international users.

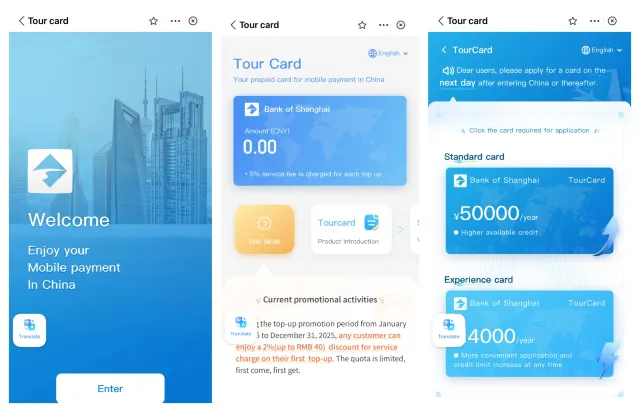

The Alipay TourCard is a prepaid virtual card issued by the Bank of Shanghai, accessible via an Alipay mini-program. Designed for international visitors, it functions like a local account, enabling payments and services that foreign cards may not support.

With TourCard, you can book train or flight tickets, send peer-to-peer (P2P) transfers, or pay small vendors, making it a versatile tool during short-term stays in China.

Follow these steps to set up the Alipay TourCard in China:

1. Open Alipay App: Ensure you’ve completed real-name verification (see above).

2. Access TourCard: Search “TourCard” in Alipay’s search bar and open the mini-program.

3. Verify Identity: Submit your passport details (name, number, date of birth, expiry). A facial scan may be required, similar to real-name verification.

4. Link a Card: Add a foreign card (Visa, Mastercard, Amex, JCB, Discover, Diners Club) to top up the TourCard.

5. Top Up Funds: Add ¥100–¥10,000 (~$14–USD 1,400) to your TourCard. A 5% service fee applies per top-up (e.g., ¥100 top-up incurs a ¥5 fee). You can apply for a ¥50,000/year or ¥14,000/year Alipay TourCard with a more convenient application process.

6. Use Funds: Once topped up, use the TourCard for any Alipay-supported service via QR code payments.

After learning how to link Alipay with a foreign credit card and understanding what Alipay TourCard is, choosing the right option depends on your travel needs in China. A linked foreign card is ideal for daily spending, while the TourCard unlocks local services, such as peer-to-peer transfers.

| Feature | Linked Foreign Card | Alipay TourCard |

| Setup | Link Visa, Mastercard, Amex, JCB, Discover, or Diners Club after real-name verification. | Access via Alipay mini-program; requires passport verification and card top-up. |

| Fees | 3% per transaction (free for ¥200 or less). Bank may add 1–3% foreign transaction fees. | 5% per top-up (e.g., ¥100 top-up costs ¥5). Bank may add foreign transaction fees. |

| Transaction Limits | ¥35,000 ($5,000 USD) per transaction; ¥350,000 ($50,000 USD) annual cap. | ¥14,000 ($2,000 USD) or ¥50,000 ($7,000 USD) annual cap; credit limit increase possible. |

| Supported Services | Stores, restaurants, some transport, online purchases (Taobao, Tmall, Didi). | All Alipay services: stores, trains/flights, P2P transfers, red packets, utilities. |

| Unsupported Services | No P2P transfers, red packets, utilities, some train bookings. | None; works like a local account. |

| Best For | Daily purchases at major merchants (hotels, chains, supermarkets). | Train/flight bookings, P2P transfers, small vendors rejecting foreign cards. |

| Cons | Limited services; some vendors reject foreign cards. | 5% top-up fee; complex refunds. |

Smart Strategy for Travelers

To maximize convenience and minimize costs in China:

Use a linked foreign card for daily spending, such as coffee, meals, or shopping at major merchants (e.g., Starbucks, Uniqlo). With a ¥35,000 (~ USD 5,000) per-transaction limit, it covers most tourist purchases. The 3% fee (free for ¥200 or less) is lower than TourCard’s 5% top-up fee.

Use TourCard for local-only services, such as sending peer-to-peer (P2P) transfers to split bills or paying small vendors that do not accept foreign cards.

To ensure Alipay works smoothly during your trip to China, preparation and smart habits are key. These practical tips help you maximize convenience, avoid common issues, and ensure seamless payments with a linked foreign card or TourCard.

Set up Alipay before leaving your home country to avoid stress:

Complete Setup Early: Finish real-name verification and link your foreign card (Visa, Mastercard, etc.) at home, where the internet is reliable. Test a small purchase (e.g., ¥10 on Taobao) to confirm functionality.

Check Bank Policies: Confirm your bank won’t block Alipay transactions or charge high foreign transaction fees (1–3%).

Once in China, use Alipay effectively with these strategies:

Set Up TourCard: If you plan to travel outside of Tier 1 cities, apply for a TourCard. Select the ¥14,000 or ¥50,000 annual cap that best suits your needs. You can apply on the next day after entering China.

Scan QR Codes: Use Alipay’s “Scan” or “Pay/Collect” feature to pay at merchants. Look for Alipay QR codes at shops, restaurants, or transport counters.

Check Fees Before Paying: For foreign cards, a 3% fee applies to transactions over ¥200; for TourCard, a 5% top-up fee applies. Always review the total before confirming.

Get a Chinese eSIM: Ensure reliable internet for Alipay transactions with a local eSIM (available at airports or online). Avoid relying on public Wi-Fi.

Use In-App Support: If issues arise (e.g., payment declined), contact Alipay’s “Customer Service” via the headset icon in the app.

Steer clear of these issues for a smooth Alipay experience:

Monitor Transaction Limits: Foreign cards are capped at ¥35,000 (~$5,000 USD) per transaction and ¥350,000 annually. TourCard has a ¥14,000 or ¥50,000 annual cap. Track spending to avoid blocks.

Carry Cash Backup: Some small vendors or rural areas may reject Alipay’s foreign card payments. Carry ¥100–¥200 in cash for emergencies.

Update the App: Regularly check for Alipay updates in the App Store or Google Play to access the latest features and avoid glitches.

Navigating China’s cashless economy is easy with Alipay, even for international travelers. Set up your payment apps with our guide and have a wonderful trip to China!

Trending Travelogues

Popular Attractions

Popular Ranked Lists

Recommended Attractions at Popular Destinations

About

Site Operator: Trip.com Travel Singapore Pte. Ltd.